银行理财是否存在风险呢?答案

Title: Understanding the Shangde Wealth Management Curriculum

In recent years, the Shangde Wealth Management Curriculum has gained attention for its comprehensive approach to financial education. Let's delve into the key components and principles of this curriculum to understand its significance and potential impact.

Introduction to Shangde Wealth Management Curriculum

The Shangde Wealth Management Curriculum is designed to provide individuals with a structured framework for understanding and managing their finances effectively. It encompasses various aspects of personal finance, investment strategies, and wealth accumulation techniques.

Key Components of the Curriculum

1.

Financial Planning Fundamentals:

The curriculum starts with the basics of financial planning, including goal setting, budgeting, and debt management. It emphasizes the importance of having a clear financial roadmap to achieve longterm objectives.

2.

Investment Principles:

Shangde teaches fundamental investment principles such as risk management, asset allocation, and diversification. It helps participants understand different investment vehicles such as stocks, bonds, mutual funds, and real estate.

3.

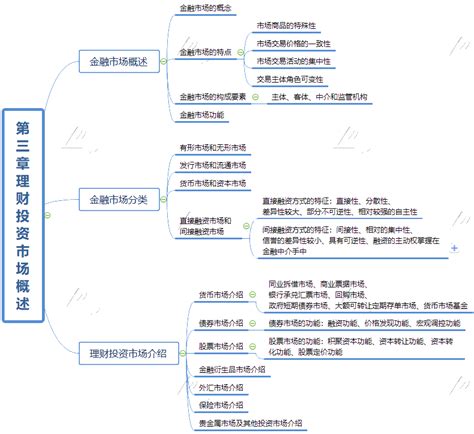

Market Analysis and Research:

Participants learn how to analyze financial markets and make informed investment decisions. This includes studying macroeconomic indicators, company fundamentals, technical analysis, and market trends.

4.

Risk Management Strategies:

The curriculum focuses on identifying and mitigating various financial risks, including market volatility, inflation, and unexpected events. It covers strategies such as insurance, emergency funds, and asset protection.

5.

Wealth Preservation Techniques:

Shangde emphasizes the importance of wealth preservation alongside wealth accumulation. It teaches strategies to safeguard assets, minimize taxes, and plan for retirement and succession.

6.

Behavioral Finance Insights:

Understanding human behavior and its impact on financial decisionmaking is crucial. The curriculum explores concepts from behavioral finance, helping participants overcome biases and make rational choices.

Advantages of Shangde Wealth Management Curriculum

1.

Comprehensive Approach:

The curriculum covers a wide range of topics essential for financial success, providing participants with a holistic understanding of wealth management.

2.

Practical Applications:

Shangde focuses on practical knowledge and realworld applications, enabling participants to apply learned concepts to their unique financial situations.

3.

Expert Guidance:

Experienced instructors and industry experts lead the curriculum, offering valuable insights and guidance based on their professional experience.

4.

Continuous Learning:

The curriculum is designed to accommodate participants at different skill levels, with opportunities for continuous learning and skill enhancement.

5.

Community Support:

Shangde fosters a supportive learning environment, encouraging peertopeer interaction and collaboration among participants.

Recommendations for Maximizing Benefits

1.

Active Participation:

Engage actively in the curriculum by attending classes, completing assignments, and participating in discussions to extract maximum value.

2.

Apply Learned Concepts:

Translate theoretical knowledge into practical actions by implementing financial plans and investment strategies in real life.

3.

Seek Professional Advice:

While the curriculum provides valuable insights, consider consulting with financial advisors or wealth management professionals for personalized guidance.

4.

Stay Updated:

Financial markets and regulations evolve continuously. Stay updated with the latest trends, news, and developments in the financial world to make informed decisions.

5.

Network and Collaborate:

Build connections with fellow participants, instructors, and industry professionals to exchange ideas, insights, and opportunities.

Conclusion

The Shangde Wealth Management Curriculum offers a structured and comprehensive approach to financial education, covering essential aspects of personal finance, investment, and wealth management. By actively participating, applying learned concepts, and seeking ongoing learning opportunities, participants can enhance their financial literacy and make informed decisions to achieve their financial goals.

[End of Document]

This HTML document provides an overview of the Shangde Wealth Management Curriculum, its key components, advantages, and recommendations for maximizing benefits. If you need further details on any specific aspect or have additional questions, feel free to ask!